Diversified Business Model and Portfolio Contribute to Strong Results

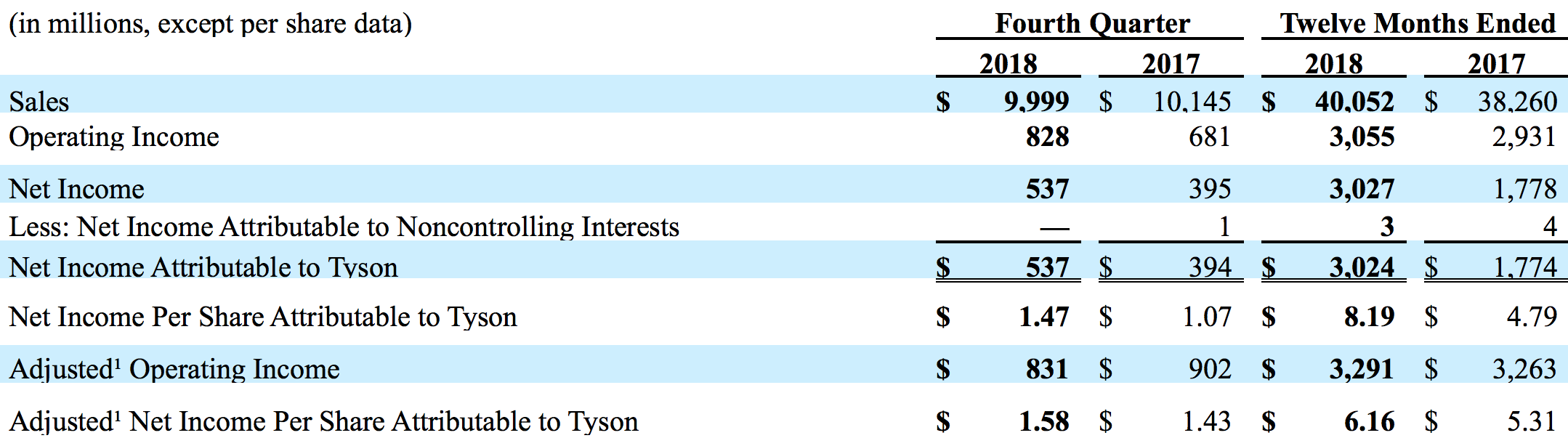

Springdale, Arkansas – November 13, 2018 – Tyson Foods, Inc. (NYSE: TSN), one of the world’s largest food companies and a recognized leader in protein with leading brands including Tyson, Jimmy Dean, Hillshire Farm, Ball Park, Wright, Aidells, ibp and State Fair, today reported the following results:

Fiscal 2018 Highlights

• Record GAAP EPS of $8.19, up 71% from last year; Record Adjusted EPS of $6.16, up 16% from last year

• Record GAAP operating income of $3,055 million; Record Adjusted operating income of $3,291 million

• Total Company GAAP operating margin of 7.6%; Adjusted operating margin of 8.2%

• Record operating cash flows of approximately $3 billion, up 14% from last year

• Record Beef and Prepared Foods operating income

Fourth Quarter Highlights

• GAAP EPS of $1.47, up 37% from last year; Adjusted EPS of $1.58, up 10% from last year

• GAAP operating income of $828 million; Adjusted operating income of $831 million

• Total Company GAAP and Adjusted operating margin of 8.3%

• Record Beef operating income of $347 million

Tax Reform Impact

• Lower enacted tax rates positively impacted the fourth quarter and twelve months Adjusted EPS by $0.20 and $0.78, respectively

Guidance

• Adjusted1 EPS guidance of $5.75-$6.10 for fiscal 2019, which is comparable to fiscal 2018 results when excluding the income from businesses held for sale before they were divested.

“Tyson Foods produced solid earnings in fiscal 2018, demonstrating the strength of our differentiated portfolio and diversified business model,” said Noel White, Tyson’s president and CEO. “We exceeded our revised guidance due to a strong finish in the fourth quarter in the Beef and Pork segments. Prepared Foods drove margin expansion, while the Chicken segment closed the gap from earlier in the year with increased promotional activity.

“While we’re not presently in a position to provide GAAP guidance1, we believe fiscal 2019 adjusted earnings will be $5.75 to $6.10 per share, based on current assumptions,” White said. “Our outlook excludes any potential impact from the closing of the Keystone acquisition and is relatively equal to fiscal 2018 earnings when excluding the income from businesses held for sale before they were divested. We expect continued strong cash flow generation as we grow sales and volume, particularly in value-added and branded products.

“I am confident in our team members and their ability to execute our strategy to sustainably feed the world with the fastest growing protein brands. Our strategy is working, and it has allowed us to produce good returns this year and will enable continued long-term growth.”

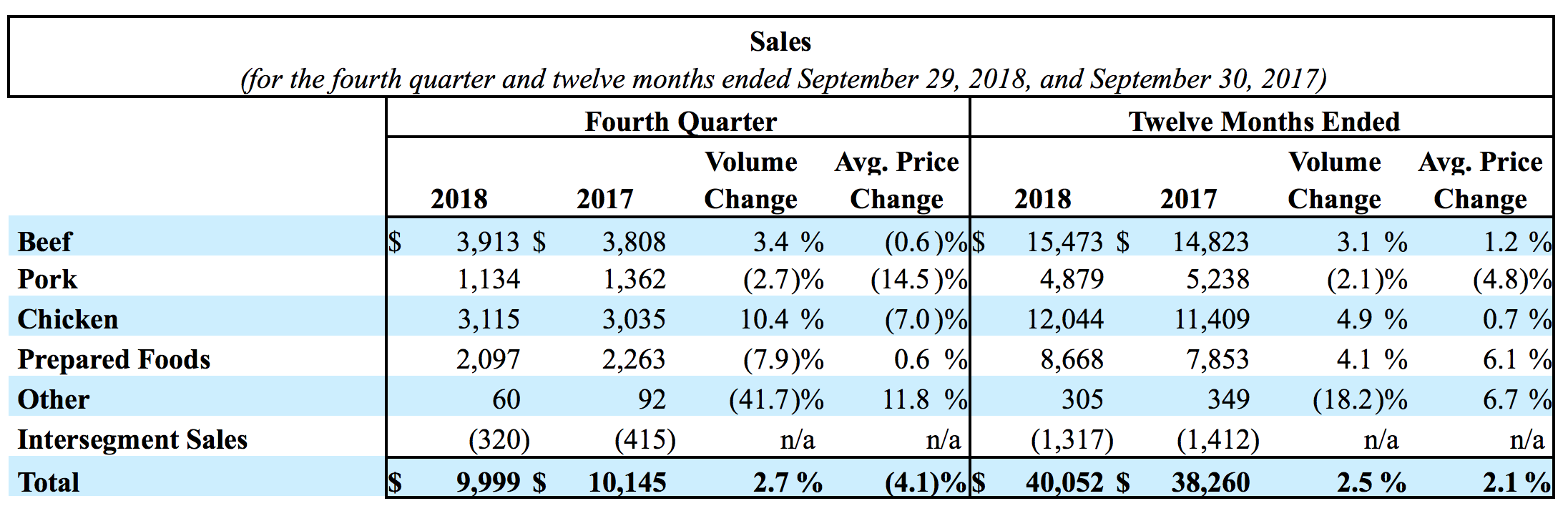

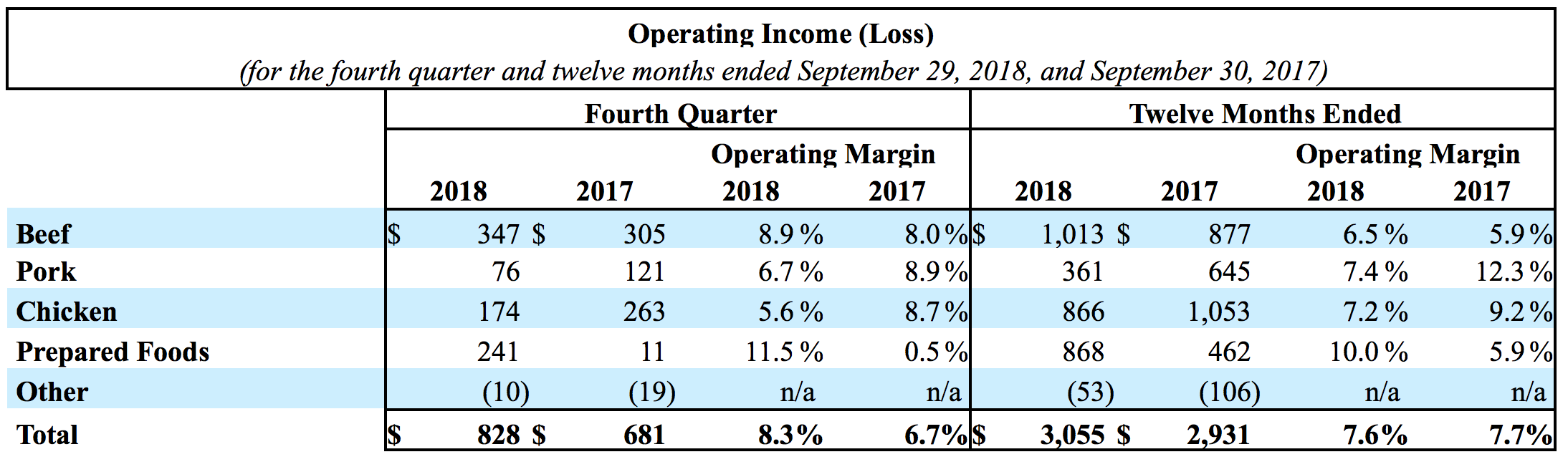

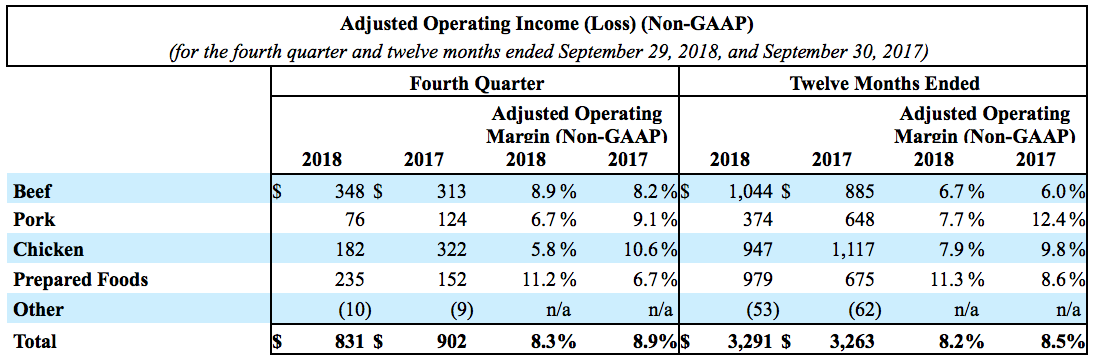

Segment Results in Millions

Note: On June 7, 2017, we acquired and consolidated AdvancePierre Foods Holdings, Inc. ("AdvancePierre"), and in fiscal 2018, we acquired Original Philly Holdings, Inc. The results from operations of these businesses are included in the Prepared Foods and Chicken segments. In fiscal 2018, we acquired Tecumseh Poultry, LLC and American Proteins, Inc. The results from operations of these businesses are included in our Chicken segment. In fiscal 2018, we completed the sale of four non-protein businesses as part of our strategic focus on protein brands. All of these businesses were part of our Prepared Foods segment and included Sara Lee® Frozen Bakery, Kettle, Van’s®, and TNT Crust.

Note: Adjusted operating income is a non-GAAP financial measure and is explained and reconciled to a comparable GAAP measure at the end of this release.

Adjusted operating income and adjusted operating margin are presented as supplementary measures in the evaluation of our business that are not required by, or presented in accordance with, GAAP. We use adjusted operating income and adjusted operating margin as internal performance measurements and as two criteria for evaluating our performance relative to that of our peers. We believe adjusted operating income and adjusted operating margin are meaningful to our investors to enhance their understanding of our financial performance and are frequently used by securities analysts, investors and other interested parties to compare our performance with the performance of other companies that report adjusted operating income and adjusted operating margin. Further, we believe that adjusted operating income and adjusted operating margin are useful measures because they improve comparability of results of operations from period to period. Adjusted operating income and adjusted operating margin should not be considered as substitutes for operating income, operating margin or any other measure of operating performance reported in accordance with GAAP. Investors should rely primarily on our GAAP results and use non-GAAP financial measures only supplementally in making investment decisions. Our calculation of adjusted operating income and adjusted operating margin may not be comparable to similarly titled measures reported by other companies.

Summary of Segment Results

• Beef - Sales volume increased due to improved availability of cattle supply, stronger demand for our beef products and increased exports. Average sales price decreased for the fourth quarter of fiscal 2018 associated with increased availability of live cattle supply and lower livestock costs. Average sales price increased for fiscal 2018 as demand for our beef products and strong exports outpaced the increase in live cattle supplies in the first six months of fiscal 2018, partially offset by lower livestock costs in the back half of fiscal 2018. Operating income increased as we continued to maximize our revenues relative to live fed cattle costs, partially offset by increased labor and freight costs and one-time cash bonus to frontline employees of $27 million incurred in the second quarter of fiscal 2018.

• Pork - Sales volume decreased as a result of balancing our supply with customer demand during a period of margin compression. The average sales price decrease for fiscal 2018 was associated with lower livestock costs. Operating income decreased from prior year record results due to periods of compressed pork margins caused by excess domestic availability of pork, higher labor and freight costs, and one-time cash bonus to frontline employees of $12 million incurred in the second quarter of fiscal 2018.

• Chicken - Sales volume increased primarily due to incremental volume from business acquisitions. Average sales price decreased for the fourth quarter of fiscal 2018 due to sales mix associated with acquisitions and lower export sales prices. Average sales price increased for fiscal 2018 due to sales mix changes and price increases associated with cost inflation, partially offset by reduced average sales prices in the fourth quarter of fiscal 2018. Operating income decreased due to increased labor, freight and growout expenses, in addition to $103 million and $61 million for the twelve months and fourth quarter of fiscal 2018, respectively, of higher feed ingredient costs and net realized and mark-to-market derivative losses as well as $51 million of one-time cash bonus to frontline employees incurred in the second quarter of fiscal 2018.

• Prepared Foods - Sales volume increased for fiscal 2018 primarily due to incremental volume from business acquisitions net of business divestitures. Sales volume decreased in the fourth quarter of fiscal 2018 due to business divestitures. Excluding the impact of the business divestitures, sales volumes in the fourth quarter of fiscal 2018 increased by 0.7%. Average sales price increased due to product mix which was positively impacted by business acquisitions and divestitures, partially offset for the fourth quarter of fiscal 2018 by the impact of pass-through sales prices from lower input costs. Operating income increased due to improved mix and net incremental results from business acquisitions, net of divestitures, partially offset by higher input and freight costs and one-time cash bonus to frontline employees of $19 million incurred in the second quarter of fiscal 2018. Additionally, operating income was impacted in fiscal 2018 by $68 million of impairments, net of realized gains, related to the divestiture of non-protein businesses. Operating income for the fourth quarter of fiscal 2017 was impacted by a $45 million impairment related to the expected sale of a non-protein business, $82 million of restructuring and related charges, and $14 million of AdvancePierre purchase accounting and acquisition-related costs. For the twelve months of fiscal 2017, operating income was impacted from $34 million of AdvancePierre purchase accounting and acquisition related costs, $97 million of impairments related to our San Diego Prepared Foods operation and the expected sale of a non-protein business, $30 million of compensation and benefits integration expense and $82 million of restructuring and related charges.

Outlook

For fiscal 2019, USDA indicates domestic protein production (beef, pork, chicken and turkey) should increase approximately 3% from fiscal 2018 levels, but we expect domestic availability of protein to increase approximately 2% as export markets should absorb a portion of the increase in production. As previously announced, in the fourth quarter of fiscal 2017, our Board of Directors approved a multi-year restructuring program (the “Financial Fitness Program”), that is expected to contribute to the Company’s overall strategy of financial fitness through increased operational effectiveness and overhead reduction. Through a combination of synergies from the integration of business acquisitions and additional elimination of non-value added costs, the program is focused on supply chain, procurement, and overhead improvements, and savings are expected to be realized in the Prepared Foods and Chicken segments. The following is a summary of the outlook for each of our segments, as well as an outlook for sales, capital expenditures, net interest expense, liquidity, tax rate and dividends for fiscal 2019.

Adjusted operating margin guidance is provided below on a non-GAAP basis2.

- Keystone Acquisition – In August 2018, we reached a definitive agreement to buy the Keystone Foods business (“Keystone”) from Marfrig Global Foods for $2.16 billion in cash. The anticipated acquisition of Keystone, a major supplier to the growing global foodservice industry, is our latest investment in the furtherance of our growth strategy and expansion of our value-added protein capabilities. The transaction is expected to close in the first quarter or early second quarter of fiscal 2019 and is subject to customary closing conditions, including regulatory approvals, however, there can be no assurance that the acquisition will close at such time. The impact of this acquisition has been excluded from the outlook.

- Sales – For fiscal 2019, we expect sales to grow to $41 billion due to volume growth and mix. Most of the sales growth is expected to occur in our Chicken segment, as well as expected growth in our Prepared Foods segment after excluding the impact of the divestitures.

- Beef – We expect industry fed cattle supplies to increase approximately 2% in fiscal 2019 as compared to fiscal 2018. We expect ample supplies in regions where we operate our plants. We believe our Beef segment's adjusted operating margin will be above 6% in fiscal 2019.

- Pork – We expect industry hog supplies to increase approximately 3% in fiscal 2019 as compared to fiscal 2018. We believe our Pork segment's adjusted operating margin will be around 6% in fiscal 2019.

- Chicken – USDA projects an increase in chicken production of approximately 2% in fiscal 2019 as compared to fiscal 2018. We believe our Chicken segment's adjusted operating margin will be near 8% in fiscal 2019.

- Prepared Foods – We believe our Prepared Foods segment's adjusted operating margin will exceed 11% in fiscal 2019.

- Other – Other includes our foreign operations related to raising and processing live chickens in China, third-party merger and integration costs and corporate overhead related to Tyson New Ventures, LLC. We expect Other adjusted operating loss to decrease in fiscal 2019.

- Capital Expenditures – We expect capital expenditures to approximate $1.5 billion for fiscal 2019. Capital expenditures will include spending for production growth, safety, animal well-being, infrastructure replacements and upgrades, and operational improvements that will result in production and labor efficiencies, yield improvements and sales channel flexibility.

- Net Interest Expense – We expect net interest expense to approximate $350 million for fiscal 2019.

- Liquidity – We expect total liquidity, which was approximately $1.4 billion at September 29, 2018, to remain above our minimum liquidity target of $1.0 billion.

- Tax Rate – We expect our adjusted effective tax rate to approximate 23.5% in fiscal 2019.

- Dividends – Effective November 12, 2018, the Board of Directors increased the quarterly dividend previously declared on August 9, 2018, to $0.375 per share on our Class A common stock and $0.3375 per share on our Class B common stock. The increased quarterly dividend is payable on December 14, 2018, to shareholders of record at the close of business on November 30, 2018. The Board also declared a quarterly dividend of $0.375 per share on our Class A common stock and $0.3375 per share on our Class B common stock, payable on March 15, 2019, to shareholders of record at the close of business on March 1, 2019. We anticipate the remaining quarterly dividends in fiscal 2019 will be $0.375 per share of our Class A and Class B stock, respectively. This results in an annual dividend rate in fiscal 2019 of $1.50 for Class A shares and $1.35 for Class B shares, or a 25% increase compared to the fiscal 2018 annual dividend rate.

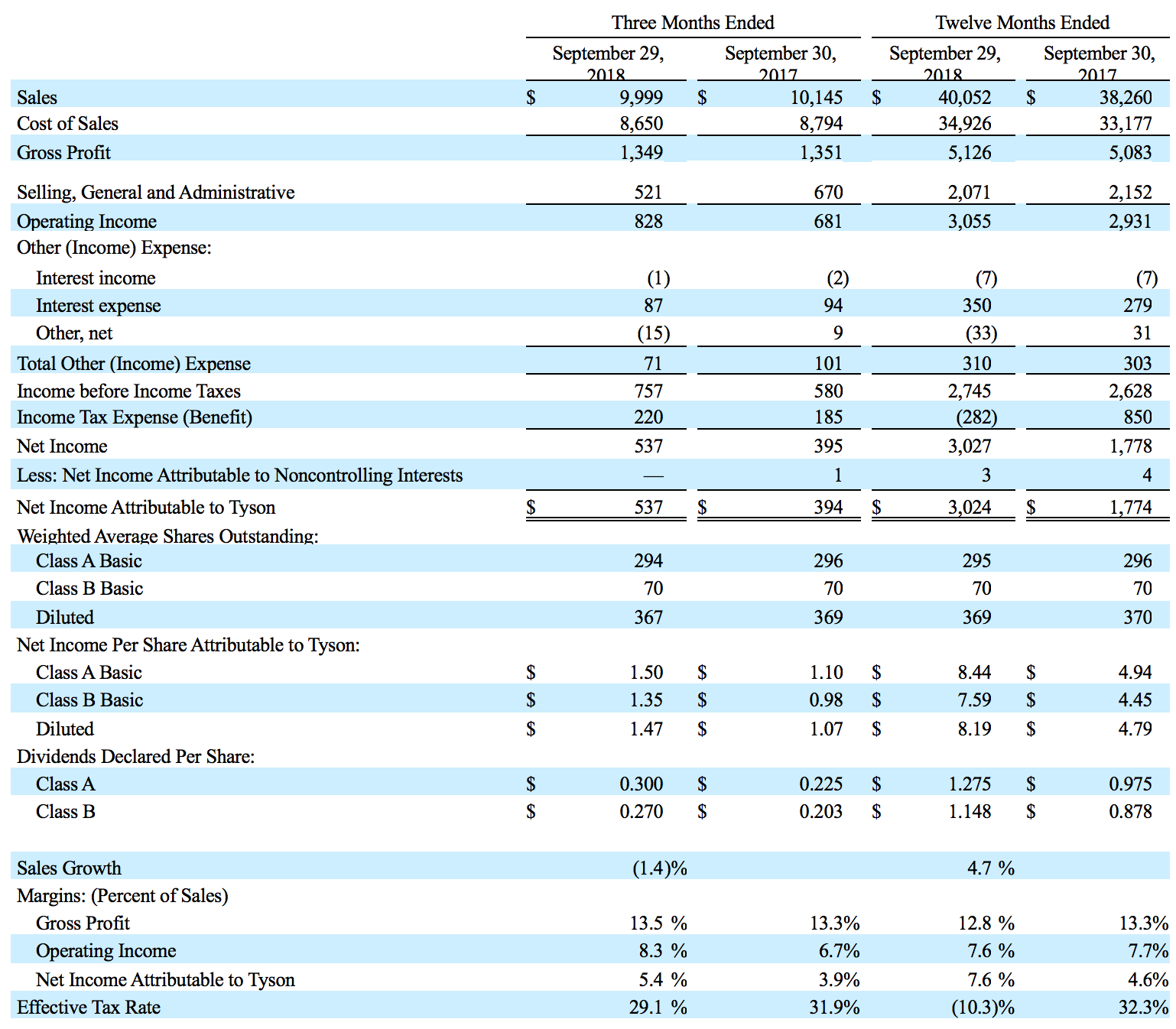

TYSON FOODS, INC.

CONSOLIDATED CONDENSED STATEMENTS OF INCOME

(In millions, except per share data)

(Unaudited)

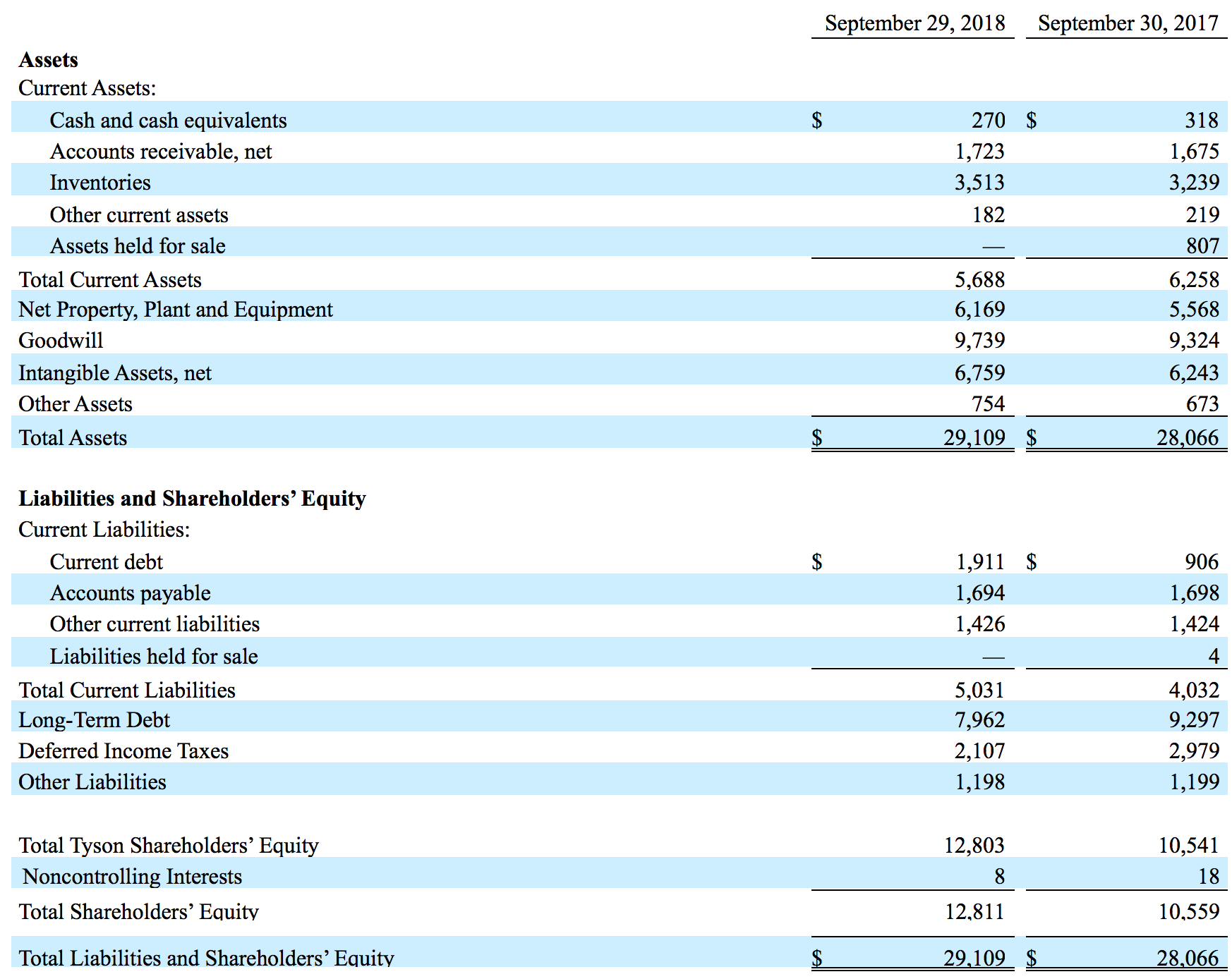

TYSON FOODS, INC.

CONSOLIDATED CONDENSED BALANCE SHEETS

(In millions)

(Unaudited)

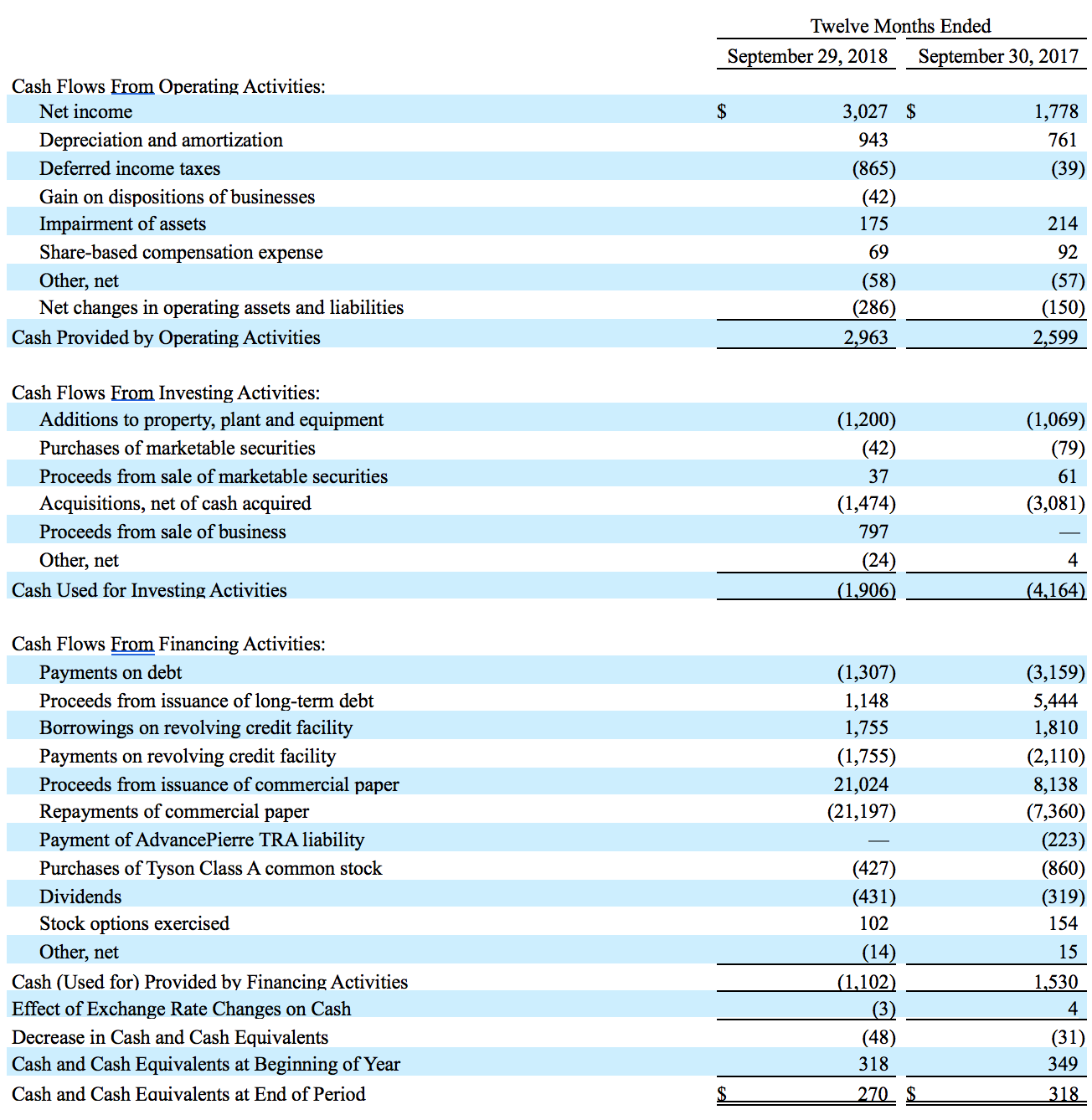

TYSON FOODS, INC.

CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS

(In millions)

(Unaudited)

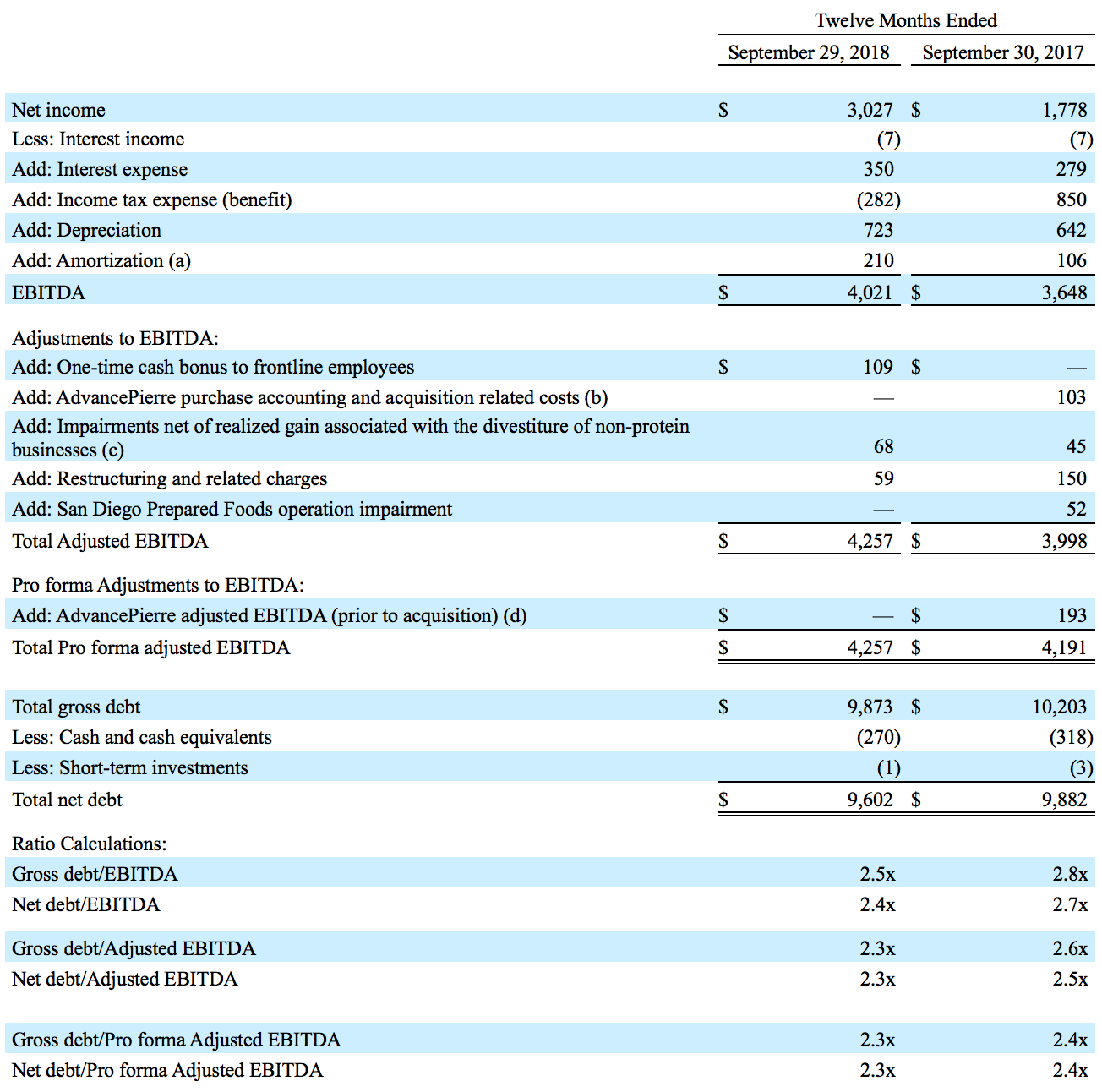

TYSON FOODS, INC.

EBITDA Reconciliations

(In millions)

(Unaudited)

- (a) Excluded the amortization of debt issuance and debt discount expense of $10 million and $13 million for the fiscal year ended September 29, 2018, and September 30, 2017, respectively, as it is included in interest expense.

- (b) AdvancePierre acquisition and integration costs for the fiscal year 2017 included $36 million of purchase accounting adjustments, $49 million acquisition related costs and $18 million of acquisition bridge financing fees.

- (c) For the fiscal year ended September 30, 2017, included an impairment related to the expected sale of a non-protein business of $45 million. For the fiscal year ended September 29, 2018, included $101 million of impairments, net of realized gains, related to the divestiture of non-protein businesses.

- (d) Represents AdvancePierre's pre-acquisition Adjusted EBITDA, for the approximate eight months ended prior to the June 7, 2017, closing of the acquisition. This amount was added to our Adjusted EBITDA for the fiscal year ended September 30, 2017, in order for Net debt to Adjusted EBITDA to include a full twelve months of AdvancePierre results on a pro forma basis for the fiscal year ended September 30, 2017. The pro forma adjusted EBITDA was derived from AdvancePierre’s EBITDA from its historical unaudited financial statements for the three months ended December 31, 2016, and April 1, 2017, as filed with the Securities and Exchange Commission, as well as AdvancePierre management unaudited financial information for the period from April 2, 2017, through the June 7, 2017, closing of the acquisition. The amount was adjusted to remove the impact of its merger, acquisition and public filing expenses as well as related expenses including consultant fees, accelerated stock-based compensation and other deal costs. We believe this pro forma presentation is useful and helps management, investors, and rating agencies enhance their understanding of our financial performance and to better highlight future financial trends on a comparable basis with AdvancePierre results included for the periods presented given the significance of the acquisition to our overall results.

EBITDA is defined as net income before interest, income taxes, depreciation and amortization. Net debt to EBITDA (Adjusted EBITDA and Pro forma Adjusted EBITDA) represents the ratio of our debt, net of cash and short-term investments, to EBITDA (and to Adjusted EBITDA and Pro forma Adjusted EBITDA). EBITDA, Adjusted EBITDA, net debt to EBITDA and net debt to Adjusted EBITDA (and to Pro forma Adjusted EBITDA) are presented as supplemental financial measurements in the evaluation of our business. Adjusted EBITDA is a tool intended to assist our management and investors in comparing our performance on a consistent basis for purposes of business decision-making by removing the impact of certain items that management believes do not directly reflect our core operations on an ongoing basis.

We believe the presentation of these financial measures helps management and investors to assess our operating performance from period to period, including our ability to generate earnings sufficient to service our debt, enhances understanding of our financial performance and highlights operational trends. These measures are widely used by investors and rating agencies in the valuation, comparison, rating and investment recommendations of companies; however, the measurements of EBITDA (and Adjusted EBITDA and Pro forma Adjusted EBITDA) and net debt to EBITDA (and to Adjusted EBITDA and Pro forma Adjusted EBITDA) may not be comparable to those of other companies, which limits their usefulness as comparative measures. EBITDA (and Adjusted EBITDA and Pro forma Adjusted EBITDA) and net debt to EBITDA (and to Adjusted EBITDA and Pro forma Adjusted EBITDA) are not measures required by or calculated in accordance with generally accepted accounting principles (GAAP) and should not be considered as substitutes for net income or any other measure of financial performance reported in accordance with GAAP or as a measure of operating cash flow or liquidity. EBITDA (and Adjusted EBITDA and Pro forma Adjusted EBITDA) is a useful tool for assessing, but is not a reliable indicator of, our ability to generate cash to service our debt obligations because certain of the items added to net income to determine EBITDA (and Adjusted EBITDA and Pro forma Adjusted EBITDA) involve outlays of cash. As a result, actual cash available to service our debt obligations will be different from EBITDA (and Adjusted EBITDA and Pro forma Adjusted EBITDA). Investors should rely primarily on our GAAP results and use non-GAAP financial measures only supplementally in making investment decisions.

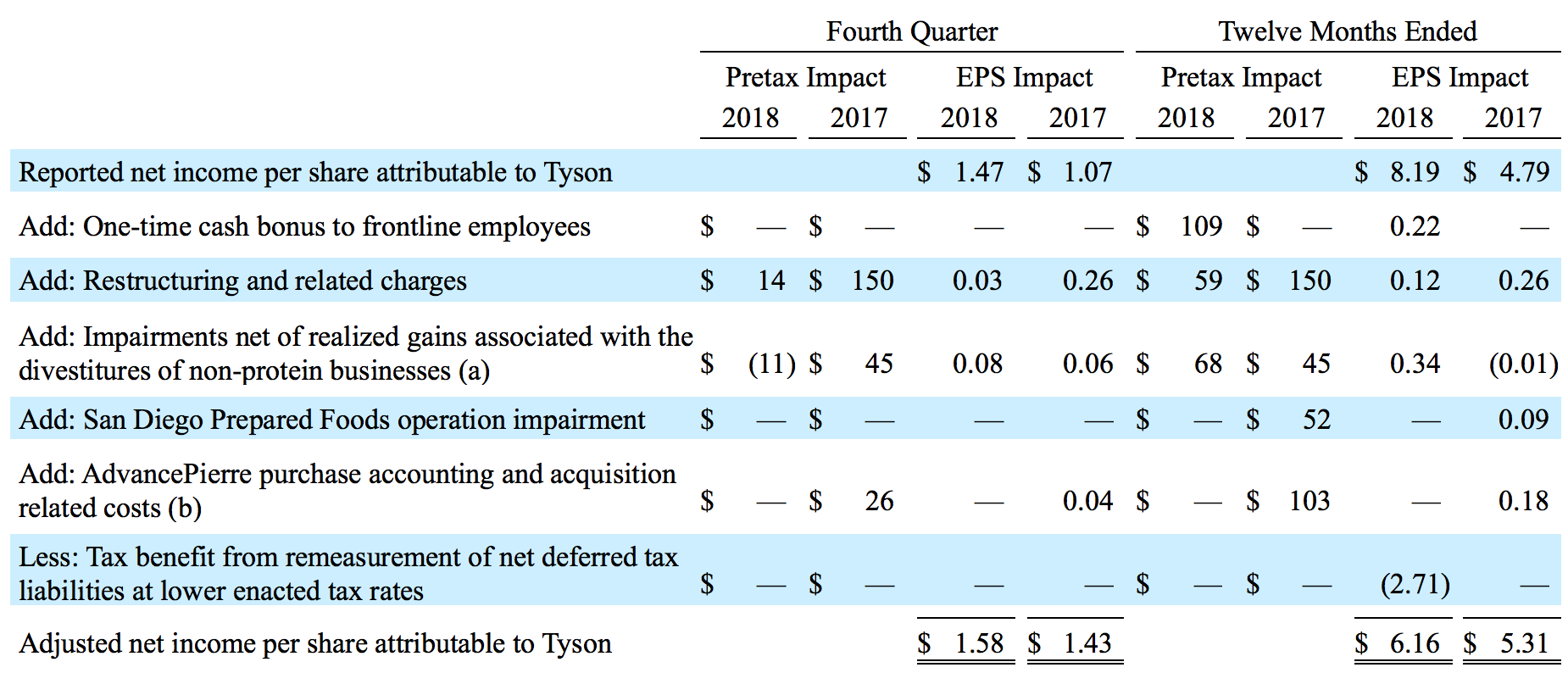

TYSON FOODS, INC.

EPS Reconciliations

(In millions, except per share data)

(Unaudited)

- (a) EPS impact for the twelve months of fiscal 2018 included $101 million of impairments related to the expected sale of a non-protein business net of a $33 million realized pretax gain associated with the sale of non-protein businesses, which combined on an after-tax basis resulted in a $0.34 impact to EPS. EPS impact for the fourth quarter of fiscal 2018 included a pretax gain, but a post-tax loss, associated with sale of a non-protein business. EPS impact for the twelve months ended fiscal 2017 included a tax benefit related to the expected sale of a non-protein business of ($0.07) recognized in the third quarter of fiscal 2017.

- (b) AdvancePierre purchase accounting and acquisition related costs for the twelve months ended September 30, 2017, included a $36 million purchase accounting adjustment for the fair value step-up of inventory, $49 million of acquisition related costs and $18 million of acquisition bridge financing fees.

Adjusted net income per share attributable to Tyson (Adjusted EPS) is presented as a supplementary measure of our financial performance that is not required by, or presented in accordance with, GAAP. We use Adjusted EPS as an internal performance measurement and as one criterion for evaluating our performance relative to that of our peers. We believe Adjusted EPS is meaningful to our investors to enhance their understanding of our financial performance and is frequently used by securities analysts, investors and other interested parties to compare our performance with the performance of other companies that report Adjusted EPS. Further, we believe that Adjusted EPS is a useful measure because it improves comparability of results of operations from period to period. Adjusted EPS should not be considered a substitute for net income per share attributable to Tyson or any other measure of financial performance reported in accordance with GAAP. Investors should rely primarily on our GAAP results and use non-GAAP financial measures only supplementally in making investment decisions. Our calculation of Adjusted EPS may not be comparable to similarly titled measures reported by other companies.

Adjusted EPS guidance is provided on a non-GAAP basis. The Company is not able to reconcile its full-year fiscal 2019 Adjusted EPS guidance to its full-year fiscal 2019 projected GAAP EPS guidance because certain information necessary to calculate such measure on a GAAP basis is unavailable or dependent on the timing of future events outside of our control. Therefore, because of the uncertainty and variability of the nature of the amount of future adjustments, which could be significant, the Company is unable to provide a reconciliation of this measure without unreasonable effort.

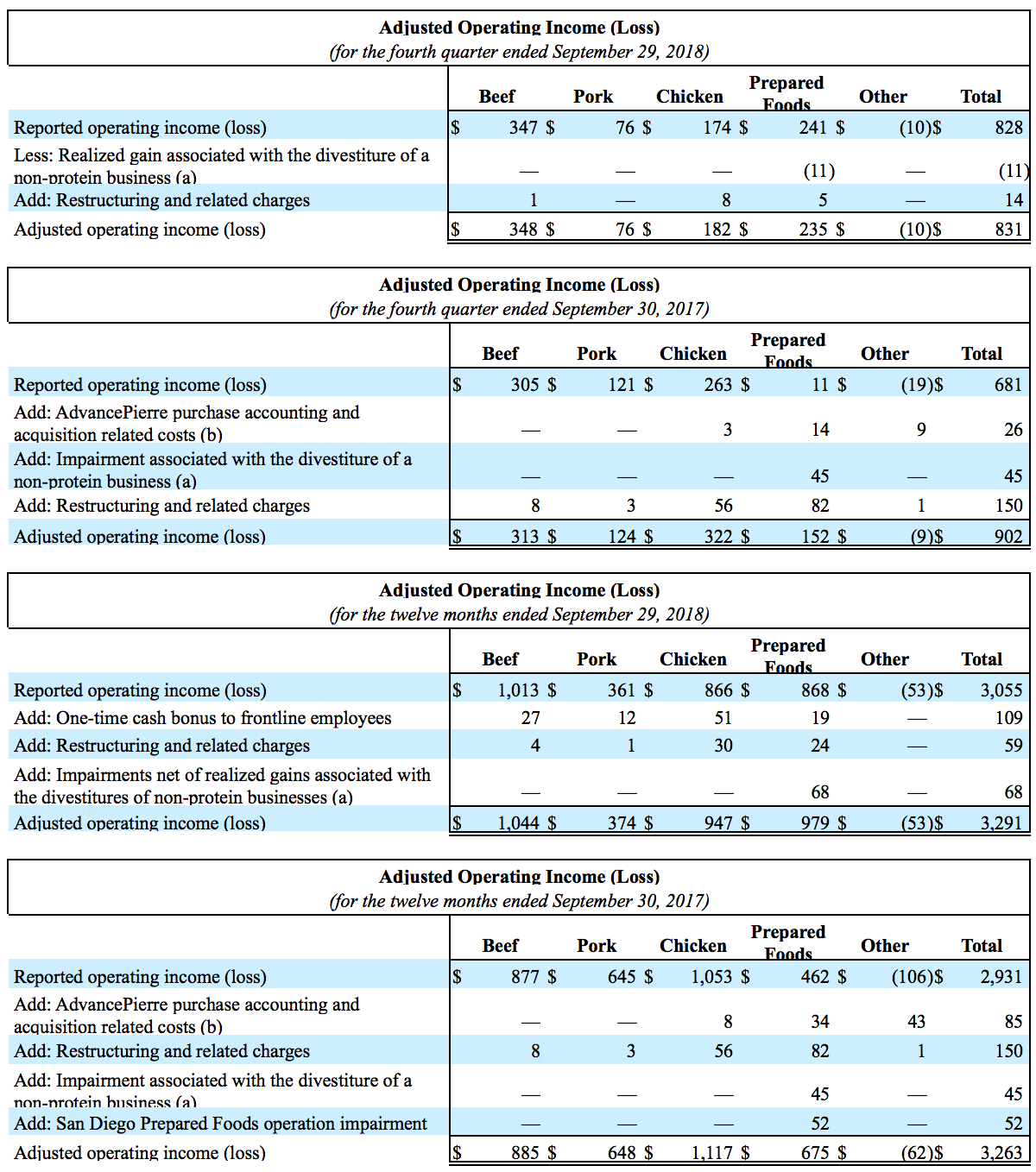

TYSON FOODS, INC.

Operating Income Reconciliation

(In millions)

(Unaudited)

- (a) Operating income impact for fiscal 2018 included $101 million of impairments related to the expected sale of a non-protein business net of $33 million realized pretax gains associated with the sale of non-protein businesses. Operating income impact for the fourth quarter of fiscal 2018 included a $11 million realized pretax gain associated with the sale of a non-protein business. Operating income impact for fiscal 2017 and the fourth quarter ended September 30, 2017 included a $45 million impairment related to the expected sale of a non-protein business.

- (b) AdvancePierre purchase accounting and acquisition related costs impacting operating income for the fourth quarter ended September 30, 2017, included a $12 million purchase accounting adjustment for the fair value step-up of inventory and $14 million of acquisition related costs. AdvancePierre purchase accounting and acquisition related costs impacting operating income for the twelve months ended September 30, 2017, included a $36 million purchase accounting adjustment for the fair value step-up of inventory and $49 million of acquisition related costs.

Adjusted operating income is presented as a supplementary measure of our operating performance that is not required by, or presented in accordance with, GAAP. We use adjusted operating income as an internal performance measurement and as one criterion for evaluating our performance relative to that of our peers. We believe adjusted operating income is meaningful to our investors to enhance their understanding of our operating performance and is frequently used by securities analysts, investors and other interested parties to compare our performance with the performance of other companies that report adjusted operating income. Further, we believe that adjusted operating income is a useful measure because it improves comparability of results of operations from period to period. Adjusted operating income should not be considered as a substitute for operating income or any other measure of operating performance reported in accordance with GAAP. Investors should rely primarily on our GAAP results and use non-GAAP financial measures only supplementally in making investment decisions. Our calculation of adjusted operating income may not be comparable to similarly titled measures reported by other companies.

Tyson Foods Inc. (NYSE: TSN) is one of the world’s largest food companies and a recognized leader in protein. Founded in 1935 by John W. Tyson and grown under three generations of family leadership, the company has a broad portfolio of products and brands like Tyson®, Jimmy Dean®, Hillshire Farm®, Ball Park®, Wright®, Aidells®, ibp® and State Fair®. Tyson Foods innovates continually to make protein more sustainable, tailor food for everywhere it’s available and raise the world’s expectations for how much good food can do. Headquartered in Springdale, Arkansas, the company had 121,000 team members at September 29, 2018. Through its Core Values, Tyson Foods strives to operate with integrity, create value for its shareholders, customers, communities and team members and serve as a steward of the animals, land and environment entrusted to it. Visit www.tysonfoods.com.

A conference call to discuss the Company's financial results will be held at 9 a.m. Eastern Tuesday, November 13, 2018. Participants may pre-register for the call at http://dpregister.com/10125848. Callers who pre-register will be given a conference passcode and unique PIN to gain immediate access to the call and bypass the live operator. Participants may pre-register at any time, including up to and after the call has started. Those without internet access or who are unable to pre-register may dial-in by calling toll free 1-844-890-1795 or international toll 1-412-717-9589.

A live webcast, including slides, will be available on the Tyson Foods Investor Relations website at http://ir.tyson.com. The webcast also can be accessed by using the direct link https://event.on24.com/wcc/r/1823453/C6E360B93B482061016BC522BB72089B. A replay of the call will be available until December 13, 2018, toll free at 1-877-344-7529, international toll 1-412-317-0088 or Canada toll free 855-669-9658. The replay access code is 10125848. Financial information, such as this news release, as well as other supplemental data, can be accessed from the Company's web site at http://ir.tyson.com.

To download TSN’s free investor relations app, which offers access to SEC filings, news releases, transcripts, webcasts and presentations, please visit the App Store for iPhone and iPad or Google Play for Android mobile devices.

Forward-Looking Statements

Certain information in this report constitutes forward-looking statements. Such forward-looking statements include, but are not limited to, current views and estimates of our outlook for fiscal 2019, other future economic circumstances, industry conditions in domestic and international markets, our performance and financial results (e.g., debt levels, return on invested capital, value-added product growth, capital expenditures, tax rates, access to foreign markets and dividend policy). These forward-looking statements are subject to a number of factors and uncertainties that could cause our actual results and experiences to differ materially from anticipated results and expectations expressed in such forward-looking statements. We wish to caution readers not to place undue reliance on any forward-looking statements, which speak only as of the date made. We undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. Among the factors that may cause actual results and experiences to differ from anticipated results and expectations expressed in such forward-looking statements are the following: (i) fluctuations in the cost and availability of inputs and raw materials, such as live cattle, live swine, feed grains (including corn and soybean meal) and energy; (ii) market conditions for finished products, including competition from other global and domestic food processors, supply and pricing of competing products and alternative proteins and demand for alternative proteins; (iii) outbreak of a livestock disease (such as avian influenza (AI) or bovine spongiform encephalopathy (BSE)), which could have an adverse effect on livestock we own, the availability of livestock we purchase, consumer perception of certain protein products or our ability to access certain domestic and foreign markets; (iv) the integration of acquisitions; (v) the effectiveness of our financial fitness program; (vi) the implementation of an enterprise resource planning system; (vii) access to foreign markets together with foreign economic conditions, including currency fluctuations, import/export restrictions and foreign politics; (viii) changes in availability and relative costs of labor and contract growers and our ability to maintain good relationships with employees, labor unions, contract growers and independent producers providing us livestock; (ix) issues related to food safety, including costs resulting from product recalls, regulatory compliance and any related claims or litigation; (x) changes in consumer preference and diets and our ability to identify and react to consumer trends; (xi) effectiveness of advertising and marketing programs; (xii) our ability to leverage brand value propositions; (xiii) risks associated with leverage, including cost increases due to rising interest rates or changes in debt ratings or outlook; (xiv) impairment in the carrying value of our goodwill or indefinite life intangible assets; (xv) compliance with and changes to regulations and laws (both domestic and foreign), including changes in accounting standards, tax laws, environmental laws, agricultural laws and occupational, health and safety laws; (xvi) adverse results from litigation; (xvii) cyber incidents, security breaches or other disruptions of our information technology systems; (xviii) our ability to make effective acquisitions or joint ventures and successfully integrate newly acquired businesses into existing operations; (xix) risks associated with our commodity purchasing activities; (xx) the effect of, or changes in, general economic conditions; (xxi) significant marketing plan changes by large customers or loss of one or more large customers; (xxii) impacts on our operations caused by factors and forces beyond our control, such as natural disasters, fire, bioterrorism, pandemics or extreme weather; (xxiii) failure to maximize or assert our intellectual property rights; (xxiv) our participation in a multiemployer pension plan; (xxv) the Tyson Limited Partnership’s ability to exercise significant control over the Company; (xxvi) effects related to changes in tax rates, valuation of deferred tax assets and liabilities, or tax laws and their interpretation; (xxvii) volatility in capital markets or interest rates; (xxviii) impacts or disruptions associated with the announcement and pendency of the acquisition of Keystone Foods; (xxix) the successful acquisition of Keystone Foods; (xxx) risks associated with our failure to integrate Keystone Foods’ operations or to realize the targeted cost savings, revenues and other benefits of the acquisition; and (xxxi) those factors listed under Item 1A. “Risk Factors” included in our Annual Report filed on Form 10-K for the period ended September 29, 2018.

Media Contact: Gary Mickelson, 479-290-6111

Investor Contact: Jon Kathol, 479-290-4235

Source: Tyson Foods, Inc.

Category: IR, Newsroom